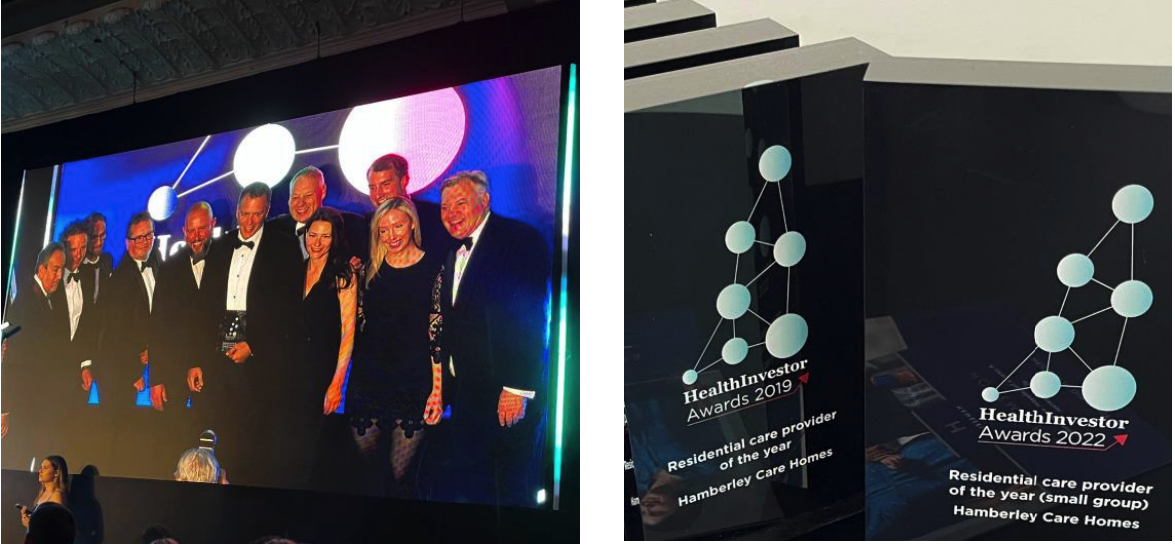

UK luxury care home operator, Hamberley Care Homes, which is backed by Patron Capital, the panEuropean institutional investor focused on property-backed investments, has won the Residential Care Provider of the Year award at the HealthInvestor Awards 2022.

Following Patron’s successes with its investments in Gracewell Healthcare and Badby Park Group, Patron continued its activity in the sector by backing the Hamberley Group, which was set up by Tim Street and Daniel Kay, two Senior Advisers at Patron Capital. Earlier in the year, Hamberley Group sold five and six of its care home properties to Rynda Healthcare and Octopus Healthcare respectively, for a total value of £200m with Hamberley Care Homes being the operator.

Hamberley Care Homes provides high quality person-centred elderly care in luxury surroundings across the UK. Over the past 12 months we have strategically grown our portfolio with the opening of four new state-of-the-art, covid-secure homes, the completion of four significant refurbishment projects and have a further 12 homes under development, firmly positioning ourselves as a leading provider of truly personalised care. Hamberley Care Homes currently have a total of 1,097 beds across its care homes with a total of 1,940 expected by 2024.

The award Judges commented:

“it is their ground breaking model of care that has been built around the Homemaker role that sets them apart from the rest. This new model of care brings a refreshing approach to the market and makes them the outright winner of this category.”

“Outstanding quality and innovative dynamic working model to deliver safe, efficient care centred on the resident’s individual needs.”

The HealthInvestor Awards 2022 is the most prestigious and well-attended awards ceremony in the health and social care sector. The awards promote excellence and recognise innovation in the independent healthcare sector and attract more than 1,200 guests each year to the JW Marriot Grosvenor House.

Keith Breslauer, Managing Director of Patron Capital, said:

“Patron has a long and successful history of developing exceptional care home properties that meet the needs of an increasingly ageing population and we are delighted that the achievements of Hamberley Care Homes have been recognised at such a prestigious award ceremony. The most recent sale transactions we’ve completed through Hamberley, with Rynda Healthcare and Octopus Healthcare, highlights the growing investor interest in the later living sector. We predict the Hamberley Group will continue to go from strength to strength.”

Media Enquiries to:

Polly Warrack t: +44 (0)7808 541191

SEC Newgate e: patron@secnewgate.co.uk

Notes to Editors

About Patron Capital Partners

Patron represents approximately €5.2 billion of capital raised across several funds and related co-investments, investing in property, corporate operating entities whose value is primarily supported by property assets and distressed debt and credit related businesses.

Since it was established in 1999, Patron has undertaken more than 200 transactions across 110 investments and programs involving over 9 million square metres in 17 countries, with many of these investments realised.

Investors represent a variety of sovereign wealth funds, prominent universities, major institutions, private foundations, and high net worth individuals located throughout North America, Europe, Asia and the Middle East. The main investment adviser to the Funds is Patron Capital Advisers LLP, which is based in London, and Patron has other offices across Europe including Barcelona and Luxembourg; the group is comprised of 61 people, including a 37-person investment team.

Further information about Patron Capital is available at www.patroncapital.com