Madrid, November 29, 2024 – LandCo, a subsidiary of Banco Santander specialising in comprehensive land development and urban planning, and Patron Capital, the pan-European institutional investor focused on property backed investments, have embarked on a new joint venture to develop 1,350 new multifamily homes across 16 real estate developments in Spain.

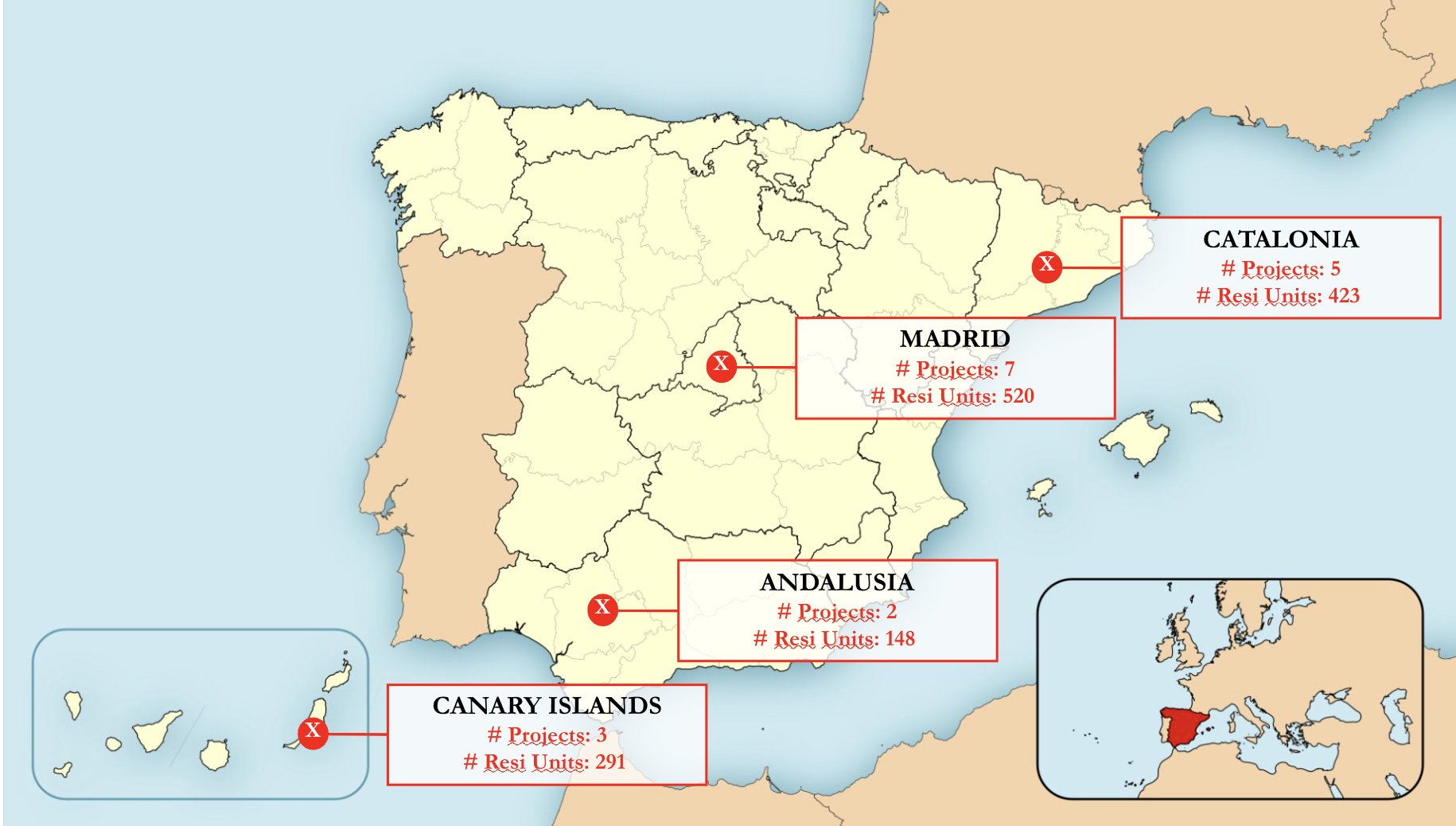

LandCo and Patron Capital plan to invest circa €365 million to deliver this initial portfolio of 16 plots of land located in major Spanish residential markets including Madrid, Seville, Barcelona, Málaga, Girona and Fuerteventura with a total buildable area of 145,000 sqm.

The plots in the portfolio are valued at approximately €100m. Ownership of the new venture is split between the two companies, with Patron Capital holding 70% and LandCo holding 30%.

The launch and marketing of the first developments will begin in Q1 2025, with all homes scheduled for completion by 2029. Under the JV, LandCo and Patron Capital are looking to target other well-located sites for residential development in Spain.

Alberto Quemada, CEO of LandCo said: “This alliance with Patron Capital reinforces our growth and expansion plan and is an endorsement of the professional urban management work that we have been carrying out for the past five years to enhance the value of our land portfolio and develop it.”

Pedro Barcelo, Senior Partner at Patron Capital, commented: “This new alliance with LandCo will enable us to further scale our presence in the Spanish residential market. There is an acute undersupply of several hundreds of thousands of homes in Spain that is presenting attractive opportunities for investors with the right skillset and expertise.

The deal highlights the appeal and potential of LandCo’s assets. It also reinforces LandCo’s strong position in the Spanish market, supported by its excellent management capabilities, expertise in urban planning and real estate development. Under the newly formed JV, LandCo will oversee the entire development process, including project design, construction, sales and providing ongoing property management services.

The JV also aligns with LandCo’s recent strategic shift where it added a specialist real estate development division to its core business of land management, transformation, and sales. LandCo is aiming to keep growing this new real estate development division through coinvestment agreements and third-party asset management mandates. LandCo is set to manage a residential portfolio comprising over 2,500 homes, once the 1,350 new homes being developed under the new venture have been added to its existing portfolio of 1,200 homes.

Spain is a key market for Patron Capital, which opened its first office in Barcelona in 2004. Since then, Patron Capital has invested approximately €1 billion acros

Notes to editors

About LandCo

Founded in 2019, LandCo was created to liquidate Banco Santander’s inherited land portfolio from the 2008 financial crisis. It operates as an integrated land developer, managing the transformation, development, and sale of all types of plots. The company’s professional and industrialized approach leverages four pillars: a skilled team, regional presence, urban and real estate expertise, and technological resources. To date, LandCo has reduced the initial portfolio transferred by Banco Santander by 4,000 assets. The company currently manages 10,000 plots in Spain and Portugal, 450 active compensation boards, and over 2,500 homes under real estate development.

About Patron Capital Partners

Patron represents approximately €5.2 billion of capital raised across several funds and related co-investments, investing in property, corporate operating entities whose value is primarily supported by property assets and distressed debt and credit related businesses.

Since it was established in 1999, Patron has undertaken more than 200 transactions across 110 investments and programs involving over 9 million square metres in 17 countries, with many of these investments realised. Investors represent a variety of sovereign wealth funds, prominent universities, major institutions, private foundations, and high net worth individuals located throughout North America, Europe, Asia and the Middle East. The main investment adviser to the Funds is Patron Capital Advisers LLP, which is based in London, and Patron has other offices across Europe including Barcelona and Luxembourg; the group is comprised of 63 people, including a 39- person investment team.

Further information about Patron Capital is available at www.patroncapital.com