Patron Capital, V L.P.

Spanish Retail - Clover

Spain

| Fund | Patron Capital, V L.P. |

| Location | Different regions in Spain (Seville, Alcoy and Cuenca) |

| Inv. Date | March 2017 |

| Inv. Strategy | Reposition |

Patron Capital, L.P. IV

Spanish Retail - Ferrol Centre

Spain

| Fund | Patron Capital, L.P. IV |

| Location | Ferrol, Spain |

| Inv. Date | July 2015 |

| Inv. Strategy | Reposition |

Patron Capital, V L.P.

Spanish Retail - Green

Spain

| Fund | Patron Capital, V L.P. |

| Location | Spain |

| Inv. Date | January 2016 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, VI L.P.

Molo

UK

| Fund | Patron Capital, VI L.P. |

| Location | UK |

| Inv. Date | August 2020 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, VI L.P.

Poland - 7R

Poland

| Fund | Patron Capital, VI L.P. |

| Location | Goleniów, Poland |

| Inv. Date | May 2020 |

| Inv. Strategy |

Patron Capital, V L.P.

Chamonix, Residential

France

| Fund | Patron Capital, V L.P. |

| Location | Chamonix, France |

| Inv. Date | December 2015 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, V L.P.

Frankfurt Europaviertel

Frankfurt, Germany

| Fund | Patron Capital, V L.P. |

| Location | Frankfurt, Germany |

| Inv. Date | June 2017 |

| Inv. Strategy | Pre-development / Development |

Patron Capital, V L.P.

Spanish Office – Lagardère

Spain

| Fund | Patron Capital, V L.P. |

| Location | Spain |

| Inv. Date | November 2016 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, V L.P.

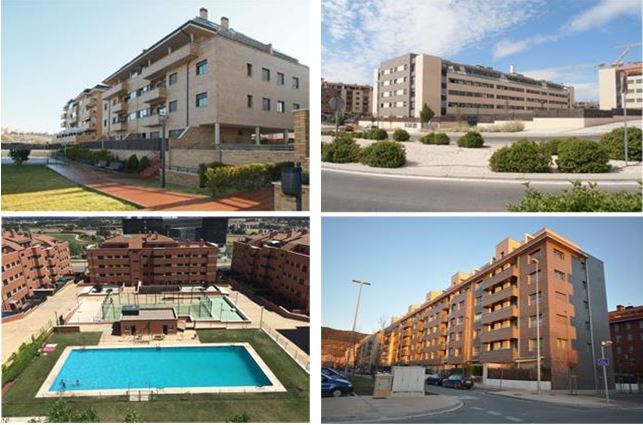

Spanish Residential – SAIS

Spain

| Fund | Patron Capital, V L.P. |

| Location | Spain |

| Inv. Date | July 2016 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, V L.P.

UK Consumer Leisure Program

United Kingdom

| Fund | Patron Capital, V L.P. |

| Location | United Kingdom |

| Inv. Date | August 2017 |

| Inv. Strategy | Operating Business / Undervalued Assets |

Patron Capital, V L.P.

Jacobs Inn

Dublin, Ireland

| Fund | Patron Capital, V L.P. |

| Location | Dublin, Ireland |

| Inv. Date | October 2017 |

| Inv. Strategy | Operating Business / Assets below intrinsic value |

Patron Capital, V L.P.

East Point Business Park

Dublin, Ireland

| Fund | Patron Capital, V L.P. |

| Location | Dublin, Ireland |

| Inv. Date | February 2016 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, V L.P.

Venloerstrasse, Cologne

Cologne, Germany

| Fund | Patron Capital, V L.P. |

| Location | Cologne, Germany |

| Inv. Date | Dec 2015 |

| Inv. Strategy | Redevelopment & reposition |

Patron Capital, L.P. IV

Piazza Savoia

Italy

| Fund | Patron Capital, L.P. IV |

| Location | Italy |

| Inv. Date | September 2012 |

| Inv. Strategy | Undervalued Asset |

Patron Capital, L.P. IV

Drive NPL Portfolio

Ireland / Poland

| Fund | Patron Capital, L.P. IV |

| Location | |

| Inv. Date | May 2014 |

| Inv. Strategy | Distressed |

Patron Capital, L.P. IV

Shared Equity Mortgages

UK

| Fund | Patron Capital, L.P. IV |

| Location | UK |

| Inv. Date | June, August 2015 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, L.P. IV

Optimum Credit

UK

| Fund | Patron Capital, L.P. IV |

| Location | |

| Inv. Date | October 2013 |

| Inv. Strategy | Operating Business / Undervalued Assets |

Patron Capital, L.P. IV

Luxury Family Hotels

UK

| Fund | Patron Capital, L.P. IV |

| Location | UK |

| Inv. Date | December 2011 |

| Inv. Strategy | Undervalued Property / Business |

Patron Capital, L.P. IV

Dutch Distressed

Netherlands

| Fund | Patron Capital, L.P. IV |

| Location | Netherlands |

| Inv. Date | Exchanged August 2012 |

| Inv. Strategy | Undervalued Assets / Distressed Seller |

Patron Capital, L.P. IV

Franklinstrasse, Berlin

Berlin, Germany

| Fund | Patron Capital, L.P. IV |

| Location | Berlin, Germany |

| Inv. Date | April 2015 |

| Inv. Strategy | Redevelopment & reposition |

Patron Capital, L.P. IV

Badby Park

UK

| Fund | Patron Capital, L.P. IV |

| Location | Daventry, Northamptonshire |

| Inv. Date | June 2012 |

| Inv. Strategy | Operating Business / Undervalued Assets |

Patron Capital, L.P. IV

Campus West, Munich

Germany

| Fund | Patron Capital, L.P. IV |

| Location | Munich, Germany |

| Inv. Date | October 2014 |

| Inv. Strategy | Undervalued Property |

Patron Capital, L.P. IV

Malakoff

France

| Fund | Patron Capital, L.P. IV |

| Location | Malakoff, France |

| Inv. Date | July 2013 June 2013 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, L.P. IV

Mercury

UK

| Fund | Patron Capital, L.P. IV |

| Location | UK |

| Inv. Date | November 2012 |

| Inv. Strategy | Distressed |

Patron Capital, L.P. IV

Mollstrasse, Berlin

Germany

| Fund | Patron Capital, L.P. IV |

| Location | Berlin |

| Inv. Date | September 2011 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, L.P. IV

Ridlerstrasse, Munich

Munich

| Fund | Patron Capital, L.P. IV |

| Location | Munich, Germany |

| Inv. Date | April 2014 |

| Inv. Strategy | Undervalued Asset |

Patron Capital, L.P. IV

The Spencer Hotel

Ireland

| Fund | Patron Capital, L.P. IV |

| Location | Dublin, Ireland |

| Inv. Date | Dec 2013 |

| Inv. Strategy | Undervalued Property / Business |

Patron Capital, L.P. IV

CALA Homes

UK

| Fund | Patron Capital, L.P. IV |

| Location | UK |

| Inv. Date | March 2013 |

| Inv. Strategy | Operating Business / Undervalued Assets |

Patron Capital, L.P. IV

UK Convenience Store Forecourt Investment Program

UK

| Fund | Patron Capital, L.P. IV |

| Location | UK |

| Inv. Date | December 2011 |

| Inv. Strategy | Undervalued Property / Business |

Patron Capital, L.P. IV

UKSPP

UK

| Fund | Patron Capital, L.P. IV |

| Location | UK |

| Inv. Date | March 2014 |

| Inv. Strategy | Distressed / Undervalued Assets |

Principal strategy involves the acquisition of undervalued commercial properties in strong regional commercial centres in the UK, where significant returns can be achieved through active asset management and exiting into the institutional or private market.

We also already have pages on Facebook, Twitter and Instagram

Patron Capital, L.P. III

Stabilfin

Italy

| Fund | Patron Capital, L.P. III |

| Location | Milan, Italy |

| Inv. Date | August 2010 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, L.P. III

Equidebt

UK

| Fund | Patron Capital, L.P. III |

| Location | UK |

| Inv. Date | December 2007 |

| Inv. Strategy | Distressed Business |

Patron Capital, L.P. III

Generator Hostels

Europe

| Fund | Patron Capital, L.P. III |

| Location | Pan-Europe |

| Inv. Date | August 2007 (Initial acquisition - London & Berlin) |

| Inv. Strategy | Operating Business / Assets below intrinsic value |

Press Articles:

You Tube Links:

Facebook:

Pinterest:

Patron Capital, L.P. III

German Industrial

Germany

| Fund | Patron Capital, L.P. III |

| Location | Aachen, Germany |

| Inv. Date | November 2007 |

| Inv. Strategy | Non Core Assets |

Patron Capital, L.P. III

German Small Property, L.P. III

Germany

| Fund | Patron Capital, L.P. III |

| Location | Leipzig, Hannover region |

| Inv. Date | August 2008 (initial) |

| Inv. Strategy | Undervalued Assets |

Katharinenstrasse / Hainstrasse

Wolfenbuettel

Braunschweig

Bruhl

Patron Capital, L.P. III

Jupiter Hotels

UK

| Fund | Patron Capital, L.P. III |

| Location | UK |

| Inv. Date | September 2011 |

| Inv. Strategy | Undervalued Property / Business |

Patron Capital, L.P. III

MENA

UK

| Fund | Patron Capital, L.P. III |

| Location | Manchester, England |

| Inv. Date | August 2010 |

| Inv. Strategy | Non Core / Undervalued Assets |

Patron Capital, L.P. III

Residential Distressed

Europe

| Fund | Patron Capital, L.P. III |

| Location | Pan-European |

| Inv. Date | August 2008 (initial) |

| Inv. Strategy | Distressed Sellers |

Patron Capital, L.P. III

Spanish Residential - Poblenou

Spain

| Fund | Patron Capital, L.P. III |

| Location | Barcelona, Spain |

| Inv. Date | November 2010 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, L.P. III

Staybridge

Europe

| Fund | Patron Capital, L.P. III |

| Location | UK |

| Inv. Date | August 2008 (Liverpool Assets) |

| Inv. Strategy | Undervalued Property / Business |

Patron Capital, L.P. III

Long Dated UK Land / Regeneration Investment

UK

| Fund | Patron Capital, L.P. III |

| Location | Berkhamsted, England |

| Inv. Date | October 2008 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, L.P. II & L.P. III

Capital Park Platform Investments

Poland

| Fund | Patron Capital, L.P. II & L.P. III |

| Location | Across Poland |

| Inv. Date | April 2005 (initial) |

| Inv. Strategy | Undervalued Assets |

Capital Park Films

Capital Park Opportunistic

Capital Park Eurocentrum

Capital Park Norblin

Capital Park Mazury

Patron Capital, L.P. II

Molin, Venice

Italy

| Fund | Patron Capital, L.P. II |

| Location | Venice, Italy |

| Inv. Date | June 2006 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, L.P. II

European Logistics

Italy

| Fund | Patron Capital, L.P. II |

| Location | Milan, Italy |

| Inv. Date | March 2005 (first property) |

| Inv. Strategy | Undervalued Property |

Patron Capital, L.P. II

German Retail Properties

Germany

| Fund | Patron Capital, L.P. II |

| Location | Across Germany |

| Inv. Date | August 2006 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, L.P. II

German Small Property, L.P. II

Germany

| Fund | Patron Capital, L.P. II |

| Location | Across Germany |

| Inv. Date | March 2006 (initial acquisition) |

| Inv. Strategy | Distressed / Undervalued Assets |

German Office / Retail (Ground Floor)

Dreieich Office Building

Opel

Hellweg

Patron Capital, L.P. II

Marina Velca

Italy

| Fund | Patron Capital, L.P. II |

| Location | Tarquinia, Italy |

| Inv. Date | October 2007 |

| Inv. Strategy | Undervalued Assets |

Patron Capital, L.P. II

Spanish Residential - BCN2

Spain

| Fund | Patron Capital, L.P. II |

| Location | Barcelona, Spain |

| Inv. Date | May 2005 |

| Inv. Strategy | Undervalued Assets |

Investment in a mixed-use portfolio from Colonial the real estate arm of La Caixa, the largest savings bank in Spain, comprising:

Patron Capital, L.P. II

UK Small Office Program, L.P. II

UK

| Fund | Patron Capital, L.P. II |

| Location | Birmingham, Croydon, Manchester, Sheffield, Leeds |

| Inv. Date | July 2005 (initial) |

| Inv. Strategy | Undervalued Assets |

Delek

Centre City

Croydon NLA Tower

Manchester - "SimChem House" - Sold

Sheffield - "City Plaza" - sold

Cloth Hall - sold

City Plaza

Birmingham - "St. Philips Point"

Patron Capital, L.P. II

Vectrane

France

| Fund | Patron Capital, L.P. II |

| Location | France (mostly Paris) |

| Inv. Date | July 2005 (first portfolio) |

| Inv. Strategy | Non Core / Undervalued Assets |

Vectrane - sold

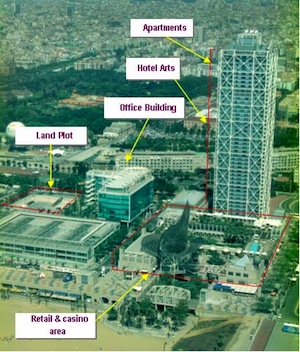

Patron Capital L.P. I

Arts

Spain

| Fund | Patron Capital L.P. I |

| Location | Barcelona, Spain |

| Inv. Date | December 2001 |

| Inv. Strategy | Complex Situation |

Parent company (Sogo) went bankrupt forcing liquidation

Assets trapped in complex corporate structure with management contract on hotel

Via corporate investment, acquisition of mixed use portfolio of approx. 1.2 million square feet consisting of:

44-story, 482-room, 5-Star Hotel Arts

12,375m² Office Building

13,084m² Retail Building

3,611 sq.m Land Parcel

Deal won "International Hotel Deal of the Year" in 2001 and Harvard Business School case study notes its success despite adversity

Effective exit achieved via sale of office building, land plot, most of retail, massive underground parking, refinancing of hotel and sale of approximately 95% of Patron's original interest into retail limited partnership structure

2nd refinancing completed early 2006 with proceeds expected in mid 2006

Hotel Arts Sold! (Press Release) (Spanish Press Articles)

Hotel Arts Spa and Pool Development

New Renovation Progresses Well

Hotel Arts Barcelona Website![]()

Harvard Case Study

Patron Capital L.P. I

Bratislava Carlton

Slovakia

| Fund | Patron Capital L.P. I |

| Location | Bratislava, Slovakia |

| Inv. Date | |

| Inv. Strategy | Complex Situation |

Acquisition of:

Hotel - 168 room four-star Carlton;

Office - 10,862m² known as the Carlton Commercial Centre (7 floors, 20 tenants) and 52-space car park;

Retail - 1,451m² retail space; and

Parking - 417 space public car park over 4 levels on a 30 year long-term contract

Flat assumptions on hotel performance and no individual asset break-up

Financial Times Article

The Bratislava Carlton Hosts President Bush, The White House and State Department in summit with Putin

President Bush Addresses Slovakian Citizens

Letter from President Bush to The Bratislava Carlton

Patron Capital L.P. I

Burzovni Palac

Czech Republic

| Fund | Patron Capital L.P. I |

| Location | Prague, Czech Republic |

| Inv. Date | |

| Inv. Strategy | Non Core Assets |

Patron Capital L.P. I

Drury Lane

UK

| Fund | Patron Capital L.P. I |

| Location | London, England |

| Inv. Date | |

| Inv. Strategy | Distressed Asset |

Patron Capital L.P. I

German Small Property, L.P. I

Germany

| Fund | Patron Capital L.P. I |

| Location | Dortmund, Berlin, Hamburg, Leipzig |

| Inv. Date | December 2004 |

| Inv. Strategy | Undervalued Assets |

German Office

German Retail

German Retail / Office

Patron Capital L.P. I

igroup

UK

| Fund | Patron Capital L.P. I |

| Location | UK |

| Inv. Date | |

| Inv. Strategy | Business Below Intrinsic Value |

Patron Capital L.P. I

Midlands

UK

| Fund | Patron Capital L.P. I |

| Location | Buxton and Droitwich, UK |

| Inv. Date | October 2002 |

| Inv. Strategy | Non Core / Undervalued Assets |

Patron Capital L.P. I

Polish NPLs

Poland

| Fund | Patron Capital L.P. I |

| Location | Poland |

| Inv. Date | July 2004 |

| Inv. Strategy | Distressed Assets |

Patron Capital L.P. I

Santa Maria

Italy

| Fund | Patron Capital L.P. I |

| Location | Milan, Italy |

| Inv. Date | August 2001 |

| Inv. Strategy | Undervalued Assets |

Patron Capital L.P. I

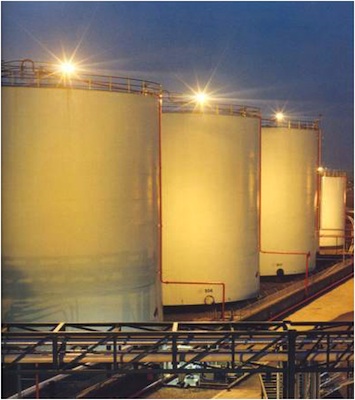

Simon Storage

UK

| Fund | Patron Capital L.P. I |

| Location | Across UK |

| Inv. Date | January 2003 |

| Inv. Strategy | Operating Business / Assets Below Intrinsic Value |

Patron Capital L.P. I

Spanish Retail Portfolio

Spain

| Fund | Patron Capital L.P. I |

| Location | Across Spain |

| Inv. Date | September 2005 |

| Inv. Strategy | Non Core / Undervalued Assets |

Patron acquired 13 non-core assets out of an original 65-asset portfolio sold by Dinosol. The assets in the portfolio comprised:

Patron Capital L.P. I

Swiss Hotels

Switzerland

| Fund | Patron Capital L.P. I |

| Location | Interlaken & Leukerbad, Switzerland |

| Inv. Date | June 2001 |

| Inv. Strategy | Distressed / Undervalued Assets |

Interlaken

Leukerbad

Patron Capital L.P. I

UK Small Office Program, L.P. I

UK

| Fund | Patron Capital L.P. I |

| Location | Birmingham and Leeds, England |

| Inv. Date | July 2004 |

| Inv. Strategy | Non Core / Undervalued Assets |

Cobalt Square (sold)

York Place (sold)